Payroll – SAGE 300 (formerly ACCPAC)

Sage 300 ERP

Count on Sage 300 ERP Payroll

Sage 300 ERP (formerly Sage ERP Accpac) allows you to process payroll consistently and accurately offers a complete and adaptable payroll solution that enables midsized businesses to Manage payroll processing internally and profitably.

Your Challenge

Regardless of the system you use—manual, outsourced, or in-house—basic payroll tasks like calculating hours worked, deductions (401(k), health, and garnishments), and benefits (auto allowance, vacation, and personal time) must be completed in every business.

These duties are crucial to the success of your business and a major factor in employee satisfaction. Payroll processing must be done correctly, promptly, and in accordance with the numerous related governmental rules. Finding the payroll processing solution for your company that is both cost-effective and efficient is the difficult part.

Your Solution

Payroll processing within your company is made possible with the Sage 300 ERP Payroll module. Eliminate double data entry because the ERP system only requires a single entry of time and payroll data, which is then easily shared. Complex payroll accounting needs can be managed by your company with ease, and timely direct transfers and processing of paychecks are also possible. each time. Utilize a range of computation techniques for employee perks, income, and deductions while adhering to the most recent adjustments to tax rates and reporting requirements. Use current US Federal and State payroll tax forms that are autopopulated with information from your Sage 300 ERP system to simplify your tax reporting. These completed forms are available for printing, signing, and sending, or you can conveniently file them electronically for a charge to save time, money, and paper.

The Bottom Line

You can receive big-business compliance protection with Sage 300 ERP Payroll without going over budget, taxing internal resources, or sacrificing functionality. With the assurance that payroll regulations are being followed and the financial advantages of drastically simplified procedures, The finest technological investment your company makes this year might be moving your payroll operations in-house.

BENEFITS

Automated Payroll Process

You can receive big-business compliance protection with Sage 300 ERP Payroll without going over budget, taxing internal resources, or sacrificing functionality. With the assurance that payroll regulations are being followed and the financial advantages of drastically simplified procedures, The finest technological investment your company makes this year might be moving your payroll operations in-house.

Seamless Connectivity

Connecting with other Sage 300 ERP modules and Sage HRMS is simple, removing the need for data entering and enhancing accuracy by reducing the chance of errors.

Streamline Tax Reporting

Processing US Federal and State Payroll Taxes is simple. You can autogenerate a finished form that is ready to print, sign, and submit, or you can pay a charge to file electronically to save time, paper, and postage.

Comprehensive Reporting

Publicize salary information that staff members can access at any time online. To go beyond the needs for payroll processing, easily accessible reports and drill-downs include full, summary, and exception reports.

Multicompany and Currency of Choice

Payroll processing is done in the currency of your choice, with an assessment and control of overall payroll costs across various divisions.

Secure Business Integrity

Protect your data, which is your most precious asset. Your sensitive information is protected thanks to Sage 300 ERP Payroll’s strict security measures.

Features

Automated Payroll Process

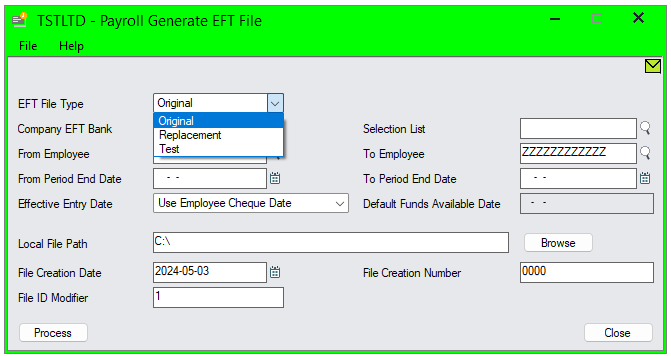

In business, money is like air. You have total control over when payroll is completed when you use an automated internal payroll process, which enables you to pay employees on schedule without having to release funds weeks before payment is due. You can accommodate all pay frequencies, different work states or provinces, and additional pay elements like cost reimbursements, accruals, and advances thanks to Sage 300 ERP Payroll’s flexibility. Establish uniform schedules that account for all employees’ accrual of vacation and sick time, regardless of length of service. Create as many schedules as necessary, or establish a single overtime payment plan for all pay frequencies. By integrating with EFT Direct Payroll, you may enable electronic payments transfers and direct deposits. Additionally, you may browse and choose employees based on a range of user-defined criteria like hourly, only covered by insurance, or only bonus personnel; you may keep track of and store this information all the way to the GL.

Seamless Connectivity

Sage 300 ERP’s flexible general ledger account structure is fully utilized by payroll to manage cost center accounting. You also have the option to easily modify the cost center for all the accounts involved by posting expenses alone, liabilities, and expenses to cost centers.

a business deal. The Payroll module delivers wage information to the relevant projects and jobs when coupled with Project Job Cost. This enables you to create certified payroll reports, track unlimited time cards, track all forms of wages and earning types, and monitor overtime vs. regular pay charged to each job. Additionally, you may track checks, manage check reversals, and maintain an audit trail of all payouts using Payroll in conjunction with Bank Services. The payroll process is further streamlined and employee data is synchronized when connected to Sage HRMS. By enabling “self-service” 24/7 access to your company’s systems from any place, you can empower your staff to perform at their highest level while also introducing new efficiencies that can boost earnings and lower expenses.

Comprehensive Reporting and eFiling

Get a wide range of reports that satisfy the reporting requirements for both American and Canadian businesses. Reports for every purpose. Use current US Federal and State payroll tax forms that are autopopulated with information from your Sage 300 ERP system to simplify your tax reporting. These completed forms are available for printing, signing, and sending, or you can conveniently file them electronically for a charge to save time, money, and paper.

Create thorough processing reports that include analysis of wages, benefits, deductions, accruals, and taxes for the pay period as well as pre- and post-check registers. Using SAP® Crystal Reports for Sage 300 ERP, you can also modify reports to meet your specific needs. Sage 300 ERP Payroll streamlines the payroll process and puts crucial information at your fingertips to increase efficiency.

Employee Payroll History

With the help of Sage Source, you can publish payroll data on a website that you manage, giving firm employees the ability to log in, see, and print their payroll histories. You can post business announcements for your staff on an online bulletin board using Sage Source.

Multicompany and Currency of Choice Support

Payroll administration across numerous businesses and nations has always been challenging, and no matter how international a corporation is, its employees must still be paid locally. The business must pay its personnel in local currency and subject them to local tax laws no matter where in the world its funds are kept. Sage 300 ERP can be set up to operate with regional payroll systems or to process payroll for both the United States and Canada right out of the box. Sage 300 ERP manages the extra complexity of managing many companies, subsidiaries, and currency requirements with ease.

Safeguarded Business Integrity

Regulated and protected! Ensure the security of the private information in your company. Your extremely sensitive payroll data is safeguarded from unwanted access or modification with the help of the Sage 300 ERP software, which guarantees thorough security measures at various levels. Additional protection for your payroll data is provided by internal IT measures like firewalls and OS security.