The CFO Suite Meets AI: The Third Generation

Every technology can be broken down into various generations as it advances, from cell phones to laptops, cars, and even software products.

The CFO suite is no exception. The first generation was the emergence of enterprise resource planning (ERP) tools, and the second was the shift to cloud-based point solutions.

The third generation involves the integration of artificial intelligence (AI) into the CFO suite.

We’re currently in the third generation of CFO tools, with AI and generative AI (GenAI) making a massive impact on how SaaS finance leaders operate.

In this post, we’re going to dissect the impact of AI on the CFO suite.

What can it do, and just as importantly, what can’t it do? How can you profitably apply this revolutionary technology?

To answer these questions, we need to start by discussing large language models (LLMs).

Sage Ai

Discover how you can use Sage Ai to make smarter, faster decisions, get a dynamic, real-time view of your business performance, and gain access to actionable insights.

How can we apply LLMs in SaaS accounting?

LLMs are AI programs capable of recognizing and generating language.

They’re trained on enormous amounts of data to facilitate this, and they’re helping SaaS CFOs streamline tasks and optimize performance in several important ways.

Currently, LLMs excel at:

- Language and image generation

- Improving financial process automation

- Working with large volumes of financial data

Despite these recent breakthroughs, LLMs are still an evolving technology with a long way to go.

What can’t LLMs do yet?

As a SaaS finance leader, being aware of the limitations of your tools can help you avoid blindly relying on them.

LLMs are a tremendously useful technology, but don’t count on them replacing you any time soon.

Currently, LLMs are lacking in a few different areas, such as:

- Nuanced reasoning

- Showing an auditable trail

- Heavy math and accounting calculations

It’s important to note that improvements are rapidly being made in these areas, and it’s only a matter of time until the kinks get worked out.

What does all this mean for you?

AI and LLMs are best suited to transactional tasks, data reconciliation, record keeping, reporting, and similar workflows. As we mentioned, it’s less optimized for strategic and financial planning.

That’s where you and your team come in.

The real value of LLMs and GenAI is that they free you up for more strategic work, which is what ultimately contributes to cash flow.

AI handles the busy work so you can focus on high-level strategy and revenue generation.

Sage Copilot

Learn about our new generative AI-powered assistant that tackles your to-do list, automates tasks, and recommends ways to help you make savings and drive improvements.

Financial workflows best suited to GenAI

Let’s drill down into some specific workflows. We’ve covered what LLMs can and can’t do in their current state of development, but how does that translate into relevant accounting workflows?

Below are 4 of the most promising use cases for LLMs and GenAI in SaaS finance. Remember, these tools are rapidly evolving. Their business applications will likely have grown by leaps and bounds in a year or two or even in the next six months.

We should also note that these business use cases apply across teams and workflows, from AR and AP to procurement, your quote to cash cycle, and many others.

1. Document review

LLMs’ ability to decode language makes them a natural fit for document review workflows.

This is especially important for subscription SaaS companies, given their need for customer contract identification.

SaaS CFOs are leveraging LLMs to simplify contract creation and data extraction from contracts.

LLMs can pull out contract data and bring it into your accounting software for analysis.

AI can even streamline contract management, from contract execution to administration.

CFOs also use LLMs to simplify workflows involving corporate leases and other business documents.

2. Data aggregation, entry, and reconciliation

LLMs shine when it comes to working with unstructured data, which is fantastic for SaaS companies because they collect huge amounts of financial and customer data as they scale.

How your organization interacts with its data is a sizable factor in its long-term success.

LLMs are helping SaaS companies with:

- Data aggregation: LLMs can extract data from multiple sources and compile it in a centralized location, making it easier for your team to use and analyze.

- Data entry: Data entry is one of the most tedious accounting tasks. GenAI can take it off your hands, giving your department more collective time for higher-value activities.

- Data reconciliation: LLMs can reconcile financial data far more rapidly and accurately than human accountants.

How else can AI simplify your department’s workflows?

3. Reporting

SaaS companies face a recurring problem around financial reporting.

Most accounting teams spend too much time assembling their reports and not enough time analyzing them.

Automation can turn that right around.

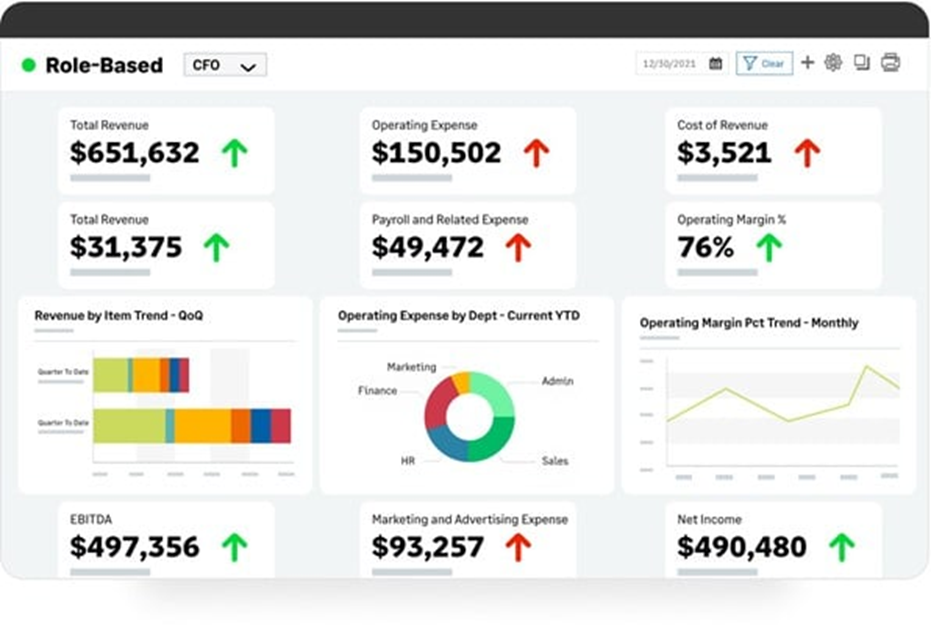

GenAI auto-populates internal and external reports to create role-based dashboards, financial statements, multi-entity reports, and more.

AI can assemble reports almost instantly, so you can devote the lion’s share of your time to analysis.

It bears repeating–strategy needs to be at the top of your priority list.

GenAI can eliminate the drudgery of report assembly and get you straight to the piece of the equation that truly matters.

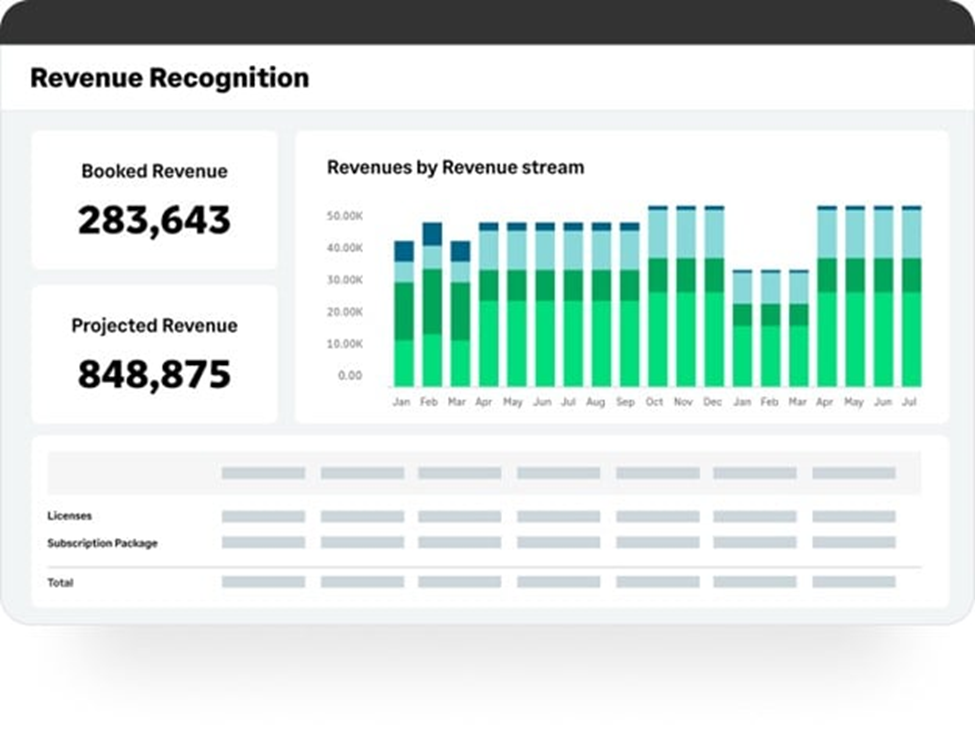

4. Compliance

For finance leaders at subscription SaaS companies, ASC 606 and IFRS 15 compliance can be a source of considerable stress.

There’s a lot riding on regulatory compliance, with the potential for large fines and even legal action in some circumstances.

And, of course, things get even more nuanced when you’re on the road to an IPO.

Luckily, GenAI is uniquely suited to compliance workflows, including:

- Detecting compliance errors

- Automating compliance audits

- Recognizing revenue per ASC 606

With an AI-fueled CFO suite, you’ll even receive automatic updates when regulatory changes occur.

What stands in the way of AI adoption?

As effective a tool as it is, some stakeholders at your company might still hesitate to adopt AI.

Understanding their hesitation can help you build a bridge to communicate effectively and overcome their objections.

After all, as the CFO, it’s largely your job to make the case for adopting AI accounting software.

Some factors that might keep your fellow stakeholders from embracing AI include:

- Fears of job loss: If you run into this objection, reassure your colleagues that the point of AI isn’t to replace human employees. It’s to free them up for more strategically valuable work.

- The “good enough” mindset: You might hear that manual accounting is “good enough” because it’s how it’s always been done. Let’s call this attitude what it is–settling for subpar results.

- Cost-related misconceptions: It’s a common misconception that AI-equipped CFO tools are extremely expensive. You can keep costs low by choosing a subscription-based software provider rather than paying a licensing fee.

Your mileage may vary when it comes to internal resistance around AI.

These tools are becoming fairly mainstream now, and AI’s positive impact on the CFO suite isn’t hard to see.

Still, preparing for some resistance can be useful if you encounter any.

The CFO suite will never be the same

Sage Intacct recently had the pleasure of hosting the Modern SaaS Finance Forum.

We discussed the incredibly rapid burst of innovation occurring in accounting AI, and the tools and strategies that SaaS finance leaders need to win their market in 2024 and beyond.

This special full-day conference had three different learning tracks (CFO, Controller, and RevOps) to help finance leaders at SaaS, AI, and high-tech companies gain a lasting competitive advantage.

Each learning track was made up of multiple 20-minute sessions with industry leaders and experts.

Not everyone could attend who might’ve wanted to, so we’ve made the conference sessions digitally available. You can listen to as few or as many as you’d like.

We had a phenomenal conversation with Seema Amble from Andreessen Horowitz about AI’s impact on the CFO suite.